An Easy Calculator for My Roth Ira

Roth IRA Calculator

If you're ready to maximize your retirement savings with the tax-free growth that a Roth IRA can provide, enter your data into our calculator to get an estimation for what your IRA will be worth at retirement.

- Updated: July 22, 2022

- This page features 7 Cited Research Articles

An individual retirement account (IRA) is an investment account that can help you build your retirement savings. A Roth IRA in particular allows your money to grow tax-free, which can be extremely beneficial for retirement savings if you maximize contributions each year.

Use the Roth IRA calculator below to understand your potential earnings — and tax savings — from contributing to this type of account.

Tip

Pull your current Roth IRA balance and the previous year's tax return to get the most accurate Roth IRA calculation.

Average Rate of Return on a Roth IRA

If you invest in specific stocks or mutual funds that follow the stock market, you can expect a 7 to 10 percent return, as historical data has shown. According to data from Goldman Sachs and S&P Global, the stock market has averaged a return of 9.2 percent over the last 140 years.

A Roth IRA is not an investment in and of itself. Instead, it's an account you keep your other investments in. With this in mind, it's important to note that your Roth IRA itself will not earn you returns, but rather the individual investments in your account.

While 9.2 percent may be the long-term average, returns can vary from year to year. However, this is a good benchmark when looking at long-term gains from stock market investments. You can also choose to invest Roth IRA contributions to bonds or certificates of deposit, all of which will offer different potential returns.

Roth IRA Calculator FAQ

If you're considering contributing to a Roth IRA, you likely have many questions. Look through some of the most commonly asked questions below or talk with a financial advisor or planner if your questions aren't addressed here.

- How much can I put in a Roth IRA each year?

- According to the IRS, the contribution limit in 2021 is $6,000 per year, or $500 per month. If you're 50 or older, the maximum contribution is $7,000.

- How much should I put into my Roth IRA?

- To set aside enough money for a comfortable retirement, the recommended contribution amount is the maximum amount allowed by the IRS. The exact amount each individual should contribute varies depending on their financial situation and desired retirement lifestyle.

- Can you lose money in a Roth IRA?

- Yes, it's possible to lose money in a Roth IRA. Most losses are dependent on market fluctuations, however, you can also lose money from early withdrawal penalties.

- What is the five-year rule for a Roth IRA?

- There are several different five-year rules. The most common refers to the five-year waiting period required before withdrawing funds from your Roth IRA.

- Do I have to report my Roth IRA on my tax return?

- Unlike contributions to a traditional IRA, the IRS has stated that you don't need to report Roth IRA contributions on tax returns.

- Can married couples have two Roth IRAs?

- Married couples, like single filers, can have multiple IRAs. However, each individual can only have one Roth IRA in their name, and joint accounts aren't permitted. Each spouse can contribute to their own account, or one spouse can contribute to both.

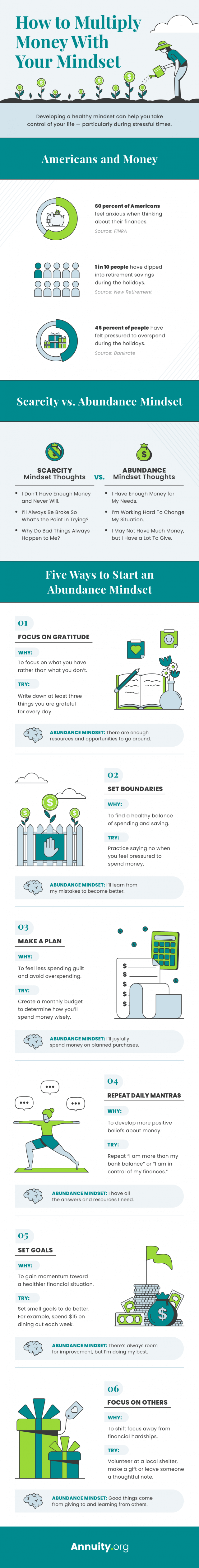

Keeping a Healthy Money Mindset When Saving for Retirement

Saving for retirement can be stressful, overwhelming and a little scary if you don't have help along the way. Talking with a financial advisor or two can help you overcome these negative feelings, but learning how to view money differently can ultimately help you thrive before and after you retire, regardless of your circumstances.

No matter what retirement accounts you choose to invest your money in, don't let a negative mindset dictate how much you set aside each month. Instead, make a retirement plan that will help you achieve your desired lifestyle and take some of the stress off of saving for your later years.

Having a plan for your retirement savings can reduce stress particularly during significant life changes or seasons where spending is high, like the holidays. Look through the visual below to understand how to build a healthier money mindset.

Planning for Retirement With a Financial Advisor

Understanding the benefits of different retirement accounts can help you see which will be the best option for you. While this Roth IRA calculator predicts potential returns and benefits, it's always best to consult a financial professional when making decisions that can impact your money and your future.

Experts in the financial field can guide you through the process of choosing an investment account. They can also help you find the best way to withdraw your funds later on — be it through purchasing an annuity, withdrawing certain percentages each month or through another method.

Please seek the advice of a qualified professional before making financial decisions.

Last Modified: July 22, 2022

7 Cited Research Articles

Annuity.org writers adhere to strict sourcing guidelines and use only credible sources of information, including authoritative financial publications, academic organizations, peer-reviewed journals, highly regarded nonprofit organizations, government reports, court records and interviews with qualified experts. You can read more about our commitment to accuracy, fairness and transparency in our editorial guidelines.

- Coxwell, K. (2015, December 16). Christmas or Retirement? Put Your Holiday Spending in Perspective. Retrieved from: https://www.newretirement.com/retirement/christmas-or-retirement-put-your-holiday-spending-in-perspective/

- Dinkytown.net Financial Calculators. (n.d.) Roth IRA Calculator. Retrieved from: https://www.dinkytown.net/java/roth-ira-calculator.html

- Garcia, A. (2018, November 19). Gift-giving guilt: Nearly half of Americans have felt pressured to overspend during the holidays. Retrieved from: (https://www.bankrate.com/personal-finance/holiday-gifting-survey-november-2018/

- IRS.gov. (2021, August 18). Retirement Topics - IRA Contribution Limits. Retrieved from: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

- IRS.gov. (2021, September 30). Retirement Topics - Exceptions to Tax on Early Distributions. Retrieved from: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

- Lin, J. et al (2019, June). The State of U.S. Financial Capability: The 2018 National Financial Capability Study. Retrieved from: https://www.usfinancialcapability.org/downloads/NFCS_2018_Report_Natl_Findings.pdf

- Scheid, B. (2020, July 15). S&P 500 returns to halve in coming decade – Goldman Sachs. Retrieved from: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/s-p-500-returns-to-halve-in-coming-decade-8211-goldman-sachs-59439981

Source: https://www.annuity.org/retirement/ira/roth-ira-calculator/

0 Response to "An Easy Calculator for My Roth Ira"

Post a Comment